Employee Benefit Plan (EBP) Audit Support

Comprehensive audit support for 401(k), 403(b), and defined benefit plans—featuring participant-level testing, DOL/IRS-aligned documentation, and Form 5500 workpapers tailored for CPA firms and plan sponsors.

Streamlined EBP Audits with Trusted Expertise

At Trusty Accounts, we understand the complexity and high stakes involved in Employee Benefit Plan (EBP) audits. Whether it's a 401(k) Plan, 403(b) Plan, or defined benefit pension plan, audits must meet rigorous Department of Labor (DOL) and IRS standards. We specialize in helping CPA firms and plan sponsors navigate this terrain with precision and confidence.

With over a decade of experience supporting U.S.-based auditors and clients, we offer backend EBP audit support that reduces fieldwork, shortens timelines, and enhances documentation quality.

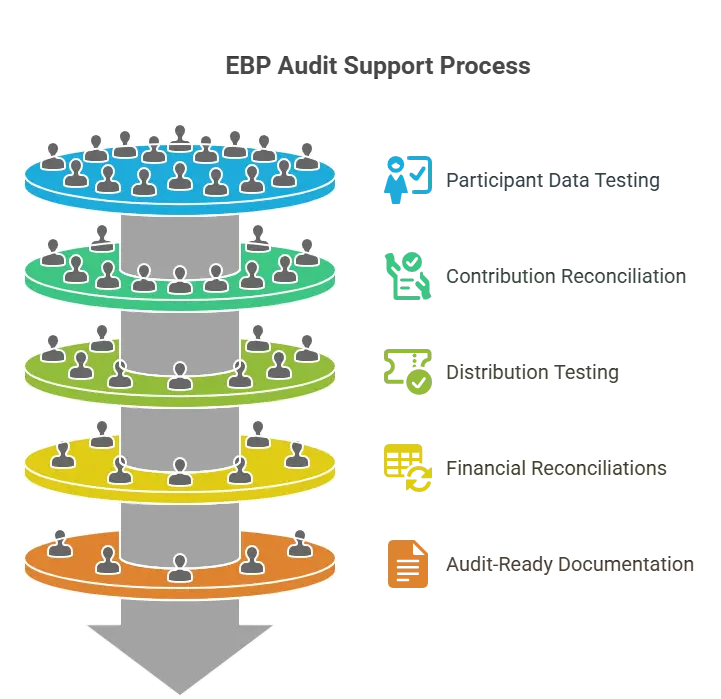

What Our EBP Audit Support Covers:

1. Participant Data Testing

- Selection of eligible participants based on plan criteria

- Verification of hire dates, birthdates, entry dates, and status

- Testing for eligibility, deferrals, and loan participation

2. Contribution & Payroll Reconciliation

- Matching of payroll records with plan deferrals and employer contributions

- Timeliness testing to confirm remittance deadlines were met

- Reconciliation of W-2 wages vs. plan compensation definitions

3. Distribution & Loan Testing

- Validation of benefit payments, loans, and hardship withdrawals

- Supporting documentation review: loan agreements, approvals, and repayment schedules

- Testing for limits, vesting rules, and IRS/DOL compliance

4. Plan-Level Financial Reconciliations

- Trial balance reconciliation with trust statements

- Investment activity rollforward testing

- Year-end asset and liability mapping to financials

5. Documentation & Audit-Ready Workpapers

- Participant selection and sample matrix preparation

- Testing templates customized per plan provisions

- Schedule C, G, H data support for Form 5500

- Summary memo drafting and lead schedule creation

📩 Ready to Simplify Your EBP Audit Season?

With Trusty Accounts, you gain more than just documentation—you gain precision, compliance, and peace of mind. Let our experts enhance your audit quality from day one.

Have a Query - Contact Now

Contact us today to explore how our EBP audit support can help you meet DOL and IRS standards with confidence. Start your 30-day free trial today—your audit-ready journey begins here.