Accounting for Non-Profits & Hospitals

Compliant fund accounting, donor reporting, and Form 990 support for nonprofits, foundations, and hospitals—built for transparency, accountability, and audit-readiness.

Grant Compliance. Donor Confidence. Mission-Focused Financial Clarity.

Nonprofits and healthcare organizations operate in a uniquely regulated and mission-driven environment. Trusty Accounts offers specialized nonprofit accounting services and hospital accounting services designed to meet the strict regulatory, donor, and audit requirements of mission-driven organizations. Our expertise in accounting for nonprofit organizations and accounting for healthcare organizations ensures accurate fund-based tracking, transparent reporting, and audit-ready documentation. From detailed nonprofit financial reporting to end-to-end medical and hospital bookkeeping, we support organizations with multi-grant tracking, donor transparency, and Form 990 preparation. We also deliver expert fund accounting for nonprofits using platforms like QuickBooks and Sage Intacct. Whether you need nonprofit audit preparation, advanced healthcare accounting solutions, or robust financial management for hospitals, Trusty Accounts is your reliable back-office partner—keeping your finances clean so you can stay mission-focused.

Our team understands the complexity of restricted and unrestricted funding, Grant accounting, and program-specific reporting required for IRS and donor compliance. We work behind the scenes to ensure that your financial statements reflect the values you uphold.

.

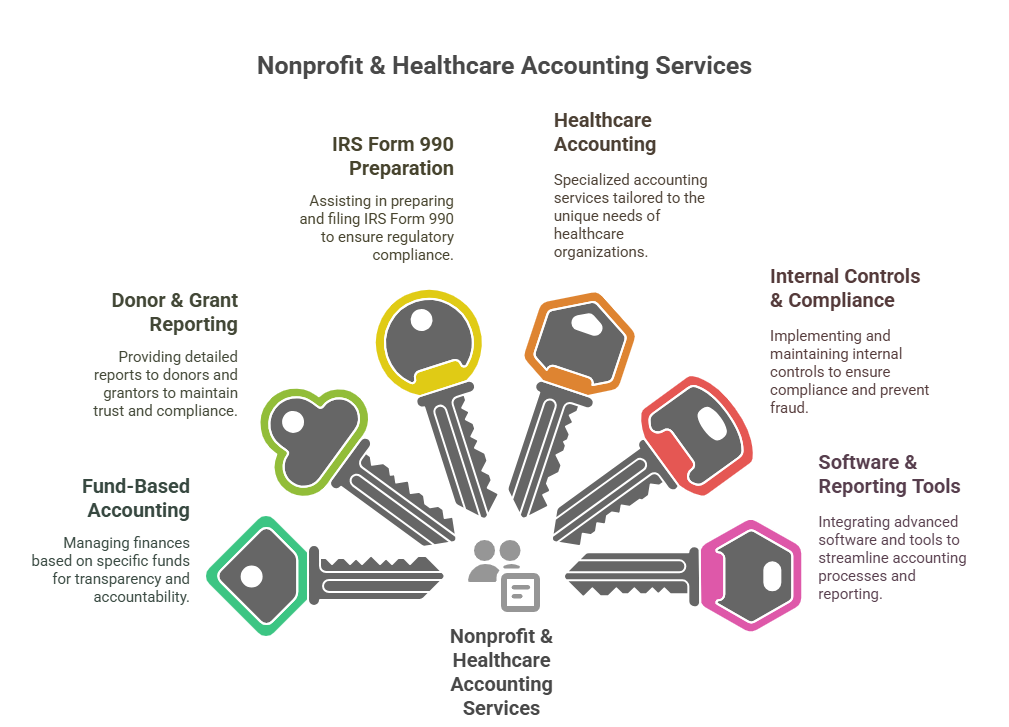

What Our Nonprofit & Healthcare Accounting Services Include:

1. Fund-Based Accounting & Reporting

- Set up and maintenance of fund structures (restricted, unrestricted, temporarily restricted)

- Accurate classification of grants, donations, and earned income

- Fund-specific general ledger tracking and reporting

2. Donor & Grant Reporting Support

- Grant expense tracking by program, project, or funding cycle

- Donor reporting packages with performance summaries

- Budget vs. actual analysis for funding compliance

3. IRS Form 990 Preparation Assistance

- Support with schedules A, B, C, and G as needed

- Tie-out of audited financials to IRS requirements

- Review-ready documentation for 990 preparation and submission

4. Healthcare-Focused Accounting

- Multi-location, multi-department financial tracking

- Support for revenue recognition across service lines and reimbursements

- Cost allocation strategies and grant fund matching

5. Internal Controls & Compliance Maintenance

- Policy and process documentation for accounting workflows

- Separation of duties and approval processes

- Walkthrough documentation and audit assistance

6. Software & Reporting Tools Integration

- QuickBooks, Xero, Sage Intacct for fund accounting

- Donor management systems like Bloomerang, NeonCRM, Donorbox

- Collaboration via cloud platforms for secure reporting access

📩 Simplify Your Compliance & Reporting Needs

Focus on your mission—we’ll take care of the books. Trusty Accounts delivers nonprofit-ready accounting support that meets every audit, every deadline, and every grant condition with confidence.

Have a Query - Contact Now

Keep your funding compliant, your donors confident, and your reporting transparent. let's connect with Trusty Accounts—specialized accounting support for nonprofits and hospitals that need more than just numbers.