Audit advisory Support Services & Compliance Assistance

End-to-end audit preparation support with working paper documentation, GL reconciliations, and internal controls assistance—tailored for CPA firms, finance teams, and compliance-heavy industries.

Pre-Audit Preparation. Process Improvement. Regulatory Confidence.

Navigating audits—whether internal, external, or regulatory—requires more than just clean books. It demands structured documentation, reconciled accounts, and a clear understanding of compliance expectations.

At Trusty Accounts, we specialize in comprehensive audit preparation support services tailored for CPA firms, finance teams, and compliance-driven organizations. From financial statement audit support and year-end close audit preparation to detailed GL reconciliations, our team ensures you're always audit-ready. We provide robust internal controls audit support, including documentation and walkthrough testing aligned with GAAP and IFRS compliance assistance. Whether you're preparing for a SEC audit documentation support, or navigating complex corporate governance and compliance consulting, our outsourced audit advisory services are designed to reduce audit stress and streamline the process. We also deliver accurate audit working papers and tie-out assistance, ensuring your financials are backed by clear logic, clean records, and regulatory confidence.

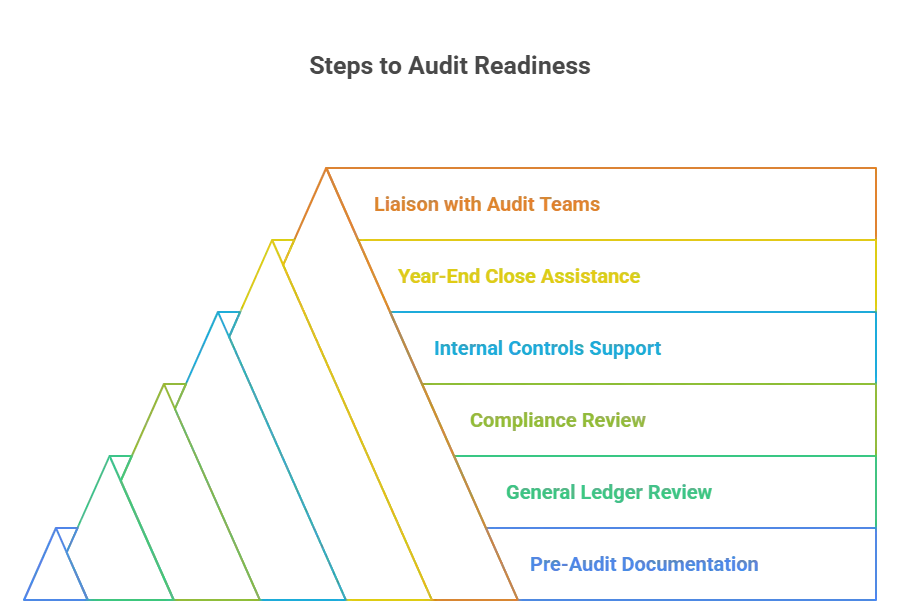

What Our Audit Support Services Include:

1. Pre-Audit Documentation Assistance

- Drafting and organizing client-prepared-by-client (PBC) lists

- Coordinating schedules and document packages for internal and external auditors

- Delivering lead schedules, trial balances, and financial summaries

2. General Ledger Review & Reconciliation

- Monthly, quarterly, and year-end reconciliation of GL accounts

- Identification and correction of misstatements or classification errors

- Supporting schedules for all balance sheet and income statement items

3. Compliance Review Support

- GAAP/IFRS compliance checks for financial statement presentation

- Preparation of notes and disclosures (support documentation only)

- Mapping of chart of accounts to reporting templates

4. Internal Controls Support

- Documentation of internal control workflows

- Support for walkthrough testing and risk assessment procedures

- Recommendations for control improvements and process efficiency

5. Year-End Close and Finalization Assistance

- Accrual entries and adjusting journal entries (AJEs)

- Depreciation, amortization, and prepaid expense schedules

- Rollforward and variance analysis for audit tie-outs

6. Liaison with Audit Teams

- Acting as point of contact for audit queries

- Explaining reconciliations, variances, and document logic

- Providing timely follow-ups to minimize disruption to operations

📩 Let’s Make Your Next Audit Smoother

Whether you’re preparing for a statutory audit, donor review, or internal audit cycle—Trusty Accounts brings structure, reliability, and consistency to the table.

Have a Query - Contact Now

Reduce audit stress with organized working papers, reconciliations, and compliance-ready documentation. Experience our pre-audit expertise risk-free —start your 30-day free trial today.