Outsourced Tax Preparation & Filing

End-to-end preparation of 1120, 1120S, 1065, 1041, and 1040 tax returns with GAAP-aligned workpapers, multi-entity support, and backend compliance documentation for CPA firms and financial controllers.

Accurate. Compliant. On Time—Every Time.

Tax season doesn’t have to be stressful. At Trusty Accounts, we provide reliable and compliant Outsourced tax preparation and filing support for CPA firms, corporations, partnerships, trusts, and individuals in the United States. Our role is simple yet critical: to make sure your returns are prepared accurately, backed by clean records, and ready for submission—well before the IRS deadlines.

We assist CPA firms and tax professionals with backend support and documentation across various entity types. Whether you're a sole proprietor needing a 1040, a firm managing dozens of S Corps, or a trust navigating 1041 complexities—we have the experience, attention to detail, and process discipline to help.

What We Handle:

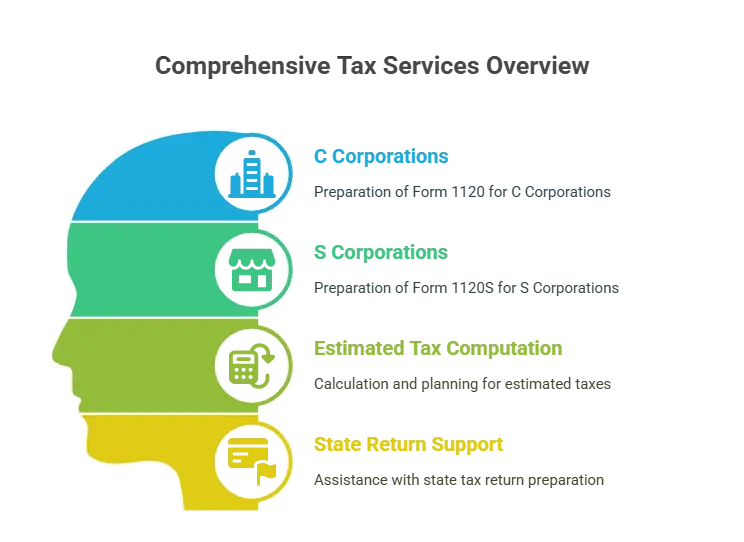

1. Corporate Tax Return Preparation

- C Corporations (Form 1120)

- S Corporations (Form 1120S)

- Estimated tax computation and planning

- State return support

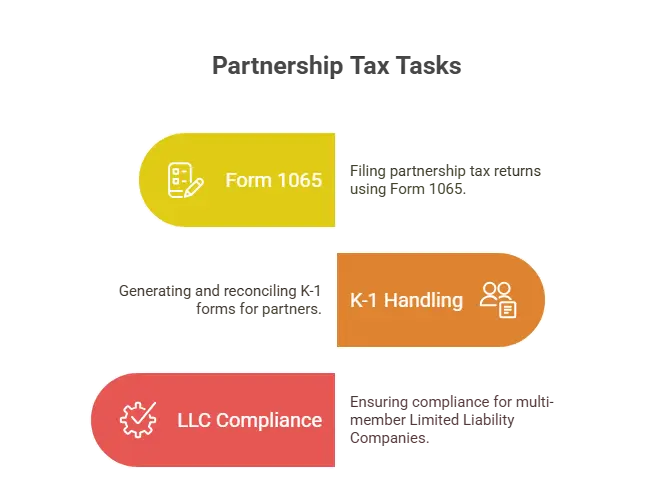

2. Partnership & LLC Tax Preparation

- Partnership returns (Form 1065)

- K-1 generation and reconciliation

- Multi-member LLC compliance

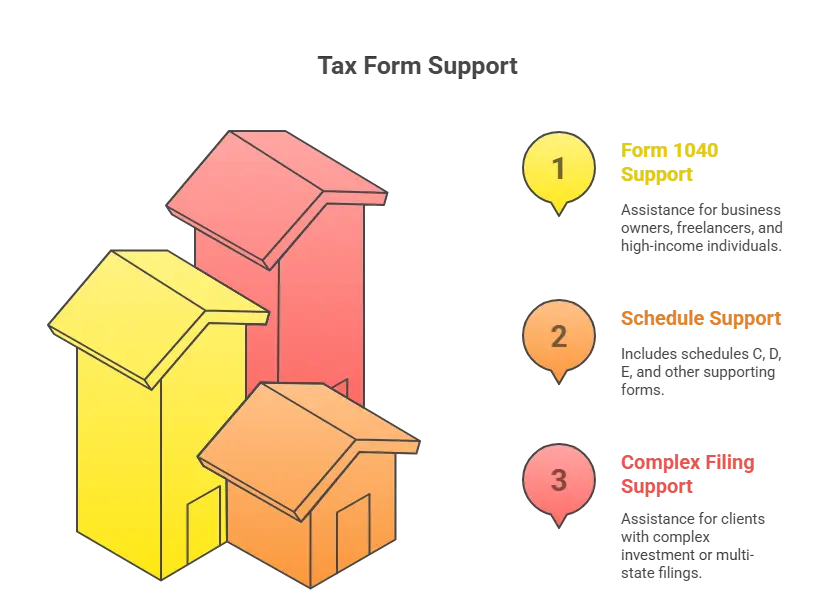

3. Individual Tax Returns (1040)

- 1040 support for business owners, freelancers, and high-income individuals

- Schedule C, D, E, and other supporting schedules

- Support for clients with complex investment or multi-state filings

4. Trust & Estate Returns (Form 1041)

- Income tax returns for trusts and fiduciaries

- Beneficiary distribution reporting and planning

5. IRS-Ready Documentation Support

We help compile:

- Income summaries

- Expense categorization

- Supporting workpapers

- Reconciliation reports

We do not e-file directly but serve as an essential support engine for tax professionals and in-house finance teams.

📩 Ready to Get Started?

Let us handle the numbers, so you can focus on growing the business. With Trusty Accounts, you’re not just getting a bookkeeping vendor—you’re gaining a long-term partner in clarity and compliance.

Have a Query - Contact Now

Experience clean books. Backed by real accountants. Delivered quietly, consistently, and with care. From 1040s to 1120S, we ensure your tax filings are accurate, timely, and IRS-compliant. Start your 30-day free trial today and experience hassle-free U.S. tax preparation.